Understanding Claim Reserves

When a workers’ compensation claim takes place within an organization, it’s critical for the insurer to supply the funds necessary to cover the cost of the claim. That’s why claim reserves are essential.

Put simply, a claim reserve refers to a specific amount of money that an insurer sets aside for paying an organization’s workers’ compensation claims. The level of funds within a reserve is determined by a claims adjuster, who makes an informed estimate of how much an organization’s claims will cost.

Accurate claim reserves play a crucial role in helping organizations and insurers alike ensure financial stability when workers’ compensation claims occur. What’s more, insurers are legally obligated to maintain adequate claim reserves under several standards—namely, the Sarbanes-Oxley Act of 2002.

How are claim reserves established

Upon the initial onset of a workers’ compensation claim, a claims adjuster will be responsible for determining how much money should be initially allocated to the associated claim reserve. Seeing as the claims adjuster must make this decision early on in the claim process—likely before the ill or injured employee has received an exact treatment and recovery regimen—the adjuster has to make an informed estimate regarding the anticipated claim expense and subsequent reserve amount.

In order to do so, the adjuster must consider potential claim costs stemming from the following categories:

- Medical — This category refers to expected expenses for the ill or injured employee’s medical diagnosis and treatment. Such costs may include those of hospital or physician visits, diagnostic testing, specialist care, prescriptions, physical therapy appointments and any transportation necessary for obtaining treatment.

- Indemnity — This category consists of anticipated costs related to the ill or injured employee’s ability to return to work (if at all) and resulting benefits. Depending on the severity of their condition, the employee may be entitled to disability or vocational rehabilitation benefits. If the employee is fatally ill or injured, their family may be entitled to death and dependent benefits.

- Expense — This category pertains to a wide range of assumed claim costs. In particular, this may include legal expenses (e.g., defense attorney payments, court costs and state filing fees) and medical management expenses (e.g., triage nurse charges and case manager costs).

The claims adjuster may estimate the initial expenses for each of these categories based on information from the employee’s latest medical reports, as well as analyze past claims involving similar illnesses or injuries to deduce such costs. As time progresses and new information related to the claim presents itself (e.g., medical prognosis changes or treatment alterations), the adjuster may either increase or decrease the initial reserve amount. However, the goal is for the initial reserve amount to be as accurate as possible, with minimal adjustments necessary.

The importance of accurate claim reserves

Maintaining accurate claim reserves is a crucial practice. After all, failing to do so can result in financial consequences for both organizations and insurers. In the scope of organizational impacts, overvalued claim reserves can lead to overstated underwriting calculations, a higher experience mod and—in turn—increased premium costs.

On the other hand, undervalued claim reserves can distort organizations’ economic outlooks—making them appear more financially stable than what they really are.

As it pertains to insurers, inaccurate claim reserves can lead to elevated loss ratios and insolvency concerns. This is because actuaries utilize reserve amounts to help determine organizations’ risk levels and resulting premium rates. With this in mind, the presence of inaccurate claim reserves could lessen actuaries’ premium calculation capabilities and motivate insurers to increase their risk appetites to more than what they can feasibly handle—potentially causing widespread financial hardship.

Case study

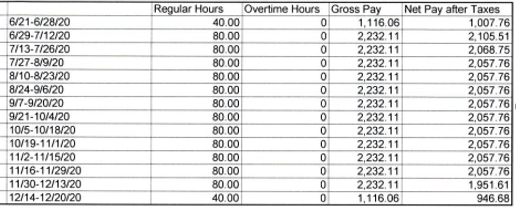

An injured worker (IW) had shoulder surgery and was unable to work three weeks total. This includes a one week waiting period and two Temporary Total Disability (TTD) checks before returning to work. The Insured Company asked about IW’s TTD checks on Tuesday because IW only received one, not two. By Insured’s calculations the one TTD check covered about six days. UNICO’s Work Comp Claims Advocate asked the Insured about the provided wage history to verify the TTD check amount. Our Claims Advocate was able to quickly determine that the carrier was capping the TTD check at the state max. Upon further investigation into the IW wage history, our Claims Advocate computed the rate to be much less than the carrier’s calculations. Our Advocate requested the carrier’s calculations, as seen below:

Gross Wages: $58,034.86/26- Average weekly wage (AWW) is calculated by adding the earnings for the 26 weeks immediately preceding the accident and dividing by 26.

- AWW: $2,232.11

- Comp Rate: $1,488.07 (max rate $914.00)

- Daily Rate: $212.58 (max rate $130.57)

- Day per week: 7

Work comp carrier TTD check calculations

The carrier incorrectly entered the IW’s average wage as weekly, instead of bi-weekly. The incorrect rate had DOUBLED the comp rate and put the IW at the state max for TTD ($914).

This isn’t necessarily a big deal for a 2 week over payment of TTD but it would be HUGE when it came time for an impairment rating as the Permanent Partial Disability (PPD) calculation doesn’t cap the weekly rate and thus would have been figured off of $1,488.07.

Claim amount before and after correction

Incorrect: 10% shoulder rating using the incorrect amount – 223 weeks X 1488.07 = $331,839.61 X 10% = $33,183.96

Correct: 10% shoulder rating using the CORRECT amount – 223 weeks X 744.04 + $165,920.92 X 10% = $16,592.09

Had the insured not contacted us about an odd TTD check, this likely never would have been caught! Our Claims Advocate would not have been alerted and wouldn’t have known to dig into the amount on the calculation the adjuster was using. Now the claim will be paid accurately when an impairment is received and it will keep the amount of the claim lower!

- Incorrect

- Correct

Our claim reserve verification lowered the claim over $16,000 and ensured the employee was paid properly in accordance to Workers’ Compensation statutes.

Ensuring sufficient claim reserves

Although insurers are ultimately responsible for maintaining sufficient claim reserves, here are some steps that organizations can take to ensure reserve accuracy:

- Communicate with all parties. Make sure to frequently communicate with all parties involved in the claim process—including the insurer, the ill or injured employee and the medical provider—to remain updated on the employee’s medical treatment and anticipated claim expenses. If it hasn’t already, request that the claim be closed out once the employee is healed and treatment has concluded to refrain from leaving it open longer than necessary.

- Conduct routine reviews. Consider working with claim representatives to engage in routine, organizational claim reviews. Doing so will shed light on typical claim costs and allow for an analysis of whether past reserve amounts provided adequate funding for their associated claims.

- Watch for red flags. Keep an eye out for potential reserve issues throughout the claim process. This may include:

- Claim inconsistencies—This problem can occur when an employee has several treatment steps ahead of them, but the claim reserve is nearly depleted. Alternatively, an employee may be close to full recovery, but the claim reserve still has significant funds leftover.

- Stair-stepping concerns—More common in long-term claims (e.g., one year or greater), this issue can arise when the claim reserve must be frequently raised in small increments over time due to a lack of initial reserve planning.

- Major reserve changes—This problem can occur when the claim reserve needs to be adjusted by 10% or more. While this issue isn’t always a red flag, it could be indicative of a larger problem if such adjustments happen right before a claim closes or don’t coincide with the latest claim information.