2020 Q4 Coverage Trends: A Hardening Market

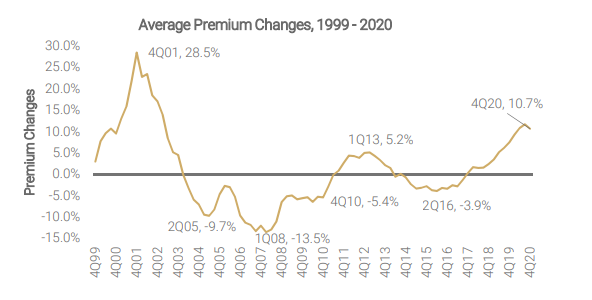

Q4 2020 was the 13th consecutive quarter of increased premiums, with an average of 10.7% across all-sized accounts. The lines of coverage that are seeing the highest increase are umbrella, D&O and commercial property.

Underwriting capacity has continued to contract. COVID-19 continues to impact pricing, availability of coverage, renewals and underwriting trends as well.

3 key takeaways by Megan Hatch

Megan Hatch, Commercial Risk Consultant, breaks down CIAB’s report and what it means for your business.

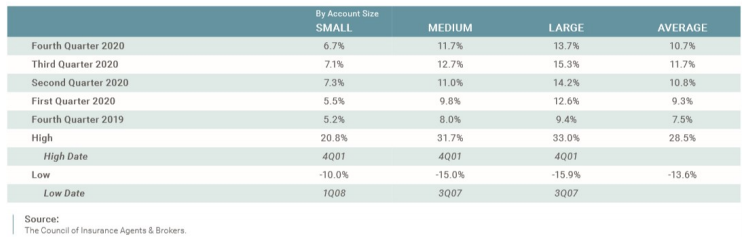

Premium pricing by company size

Pricing increases moderated slightly in Q4 2020 in comparison to Q2 and Q3 of the same year, but remained relatively high, suggesting that the market continued to harden. Across all-sized accounts, the average premium increase was 10.7%, down slightly from 11.7% in Q3 2020. Large accounts specifically recorded an average premium increase of 13.7%, the fourth consecutive quarter of increases above 10% for this account size– compared to 15.3% in Q3. Large accounts were the most impacted by Q4 market conditions.

Medium accounts were also impacted, as respondents reported an average premium increase of 11.7% for that account size, the 3rd consecutive quarter of increases above 10%. Small accounts saw an average premium increase of 6.7%, continuing the trend of being more insulated from market changes than medium or large accounts.

What is a hard market?

- In the insurance industry, the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases. This can be caused by a number of factors, including falling investment returns for insurers, increases in frequency or severity of losses, and regulatory intervention deemed to be against the interests of insurers.

- Right now, we are seeing a shift in the market. It has been a soft market for several years, but is now hardening and expected to continue in 2021.

- We are seeing premiums increase across the board, not specific to certain industries. In some cases, we are seeing increases even without any claim activity.

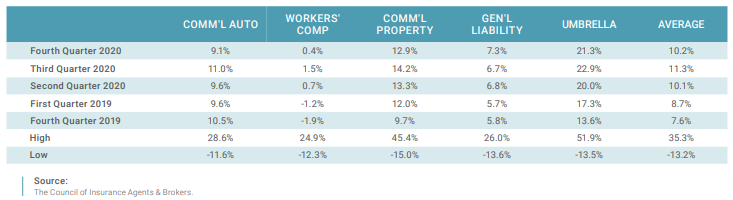

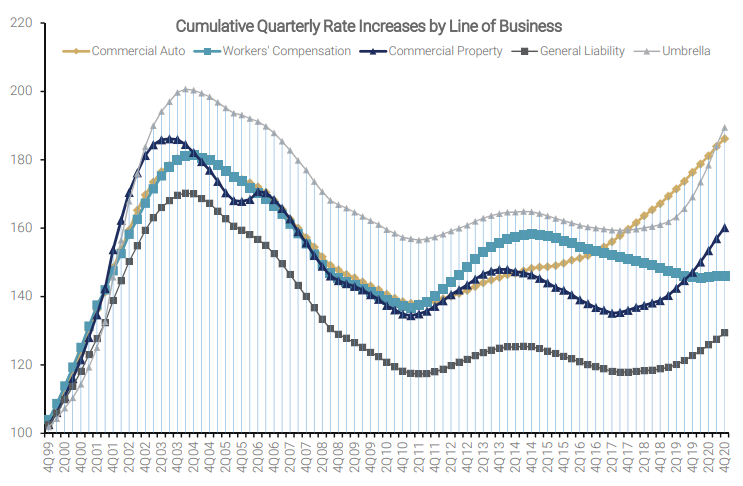

Premium pricing by line of business

Q4 2020 was the 3rd consecutive quarter where all lines, including Workers Compensation, had an increase in premiums, though the increases were generally slightly less than in Q3. Across the major lines, the average premium price increase was 10.2%, compared to 11.3% in Q3 and 10.1% in Q2.

“The worst of the pandemic may have passed, but broker struggles continued into Q4 2020,” said Ken A. Crerar, President/CEO of The Council. “Umbrella and D&O liability posed continued challenges due to a reluctance for carriers to write those risks, and new trouble for cyber emerged following a recent uptick in costly ransomware attacks in 2020. Brokers should stand ready to help their clients understand and navigate these challenging market conditions and identify new and emerging risks.”

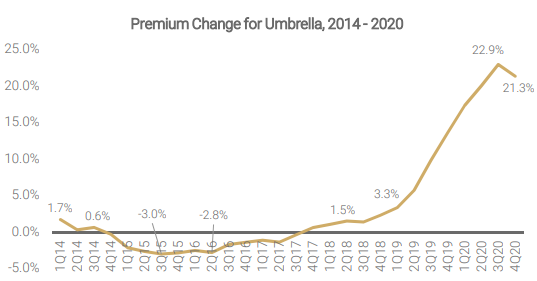

Umbrella

Premium prices for Umbrella increased by an average of 21.3%, marking the 3rd consecutive quarter of a price increase above 20% for the line.

Respondents provided similar explanations for these increases to those from previous quarters. Nuclear verdicts were a key reason many respondents said carriers used as justification for the increases; as one respondent from a large Northeastern firm put it, “‘Nuclear’ verdicts were a major explanation. There were more $10M+ judgements and the higher limits were not priced expecting this trend.” According to another respondent from a midsized Northwestern firm, “[The carriers] said that more of the nuclear court decisions are hitting them. They used to not get hit on the umbrella, but with the increased awards from court judgments they were being hit with claims.”

What changes have occurred over the last several quarters?

- Umbrella seeing on average a 21.3% increase. The key reason behind this is due to nuclear verdicts. There has also been mention of umbrellas being underpriced for years.

- D&O with an average of 14.7%.

- Commercial Property at 12.9%.

- Cyber is seeing double digit increases for the first time at 11.1%. why the major increase? Carriers are getting nervous about Ransomware. There has been an influx in claims within the Cyber space, and with more people working from home now due to the pandemic, we are seeing this trend continue.

Increased premium trends

Q4 2020 was the 13th consecutive quarter of increased premiums, with respondents reporting an average increase of 10.7% across all-sized accounts. Segmenting out the data by account size, premiums increased the most for large accounts, at 13.7%, followed by medium accounts at 11.7%. Premiums for small accounts again saw a smaller average increase in Q4 2020, at 6.7%, compared to 7.1% in Q3 and 7.3% in Q2.

Q4 2020 was also the 3rd consecutive quarter in which premiums increased for all lines, including Workers Compensation. Across all lines the average premium increase was 10.2% in Q4 2020, compared to 11.3% in

Q3. Looked at individually, Umbrella recorded the highest premium increase, at 21.3%, followed by D&O Liability at 14.7% and Commercial Property at 12.9%.

What does this mean for your risk management program?

- With these changes it is critical for organizations to work with their risk advisor to understand what impacts this all could have on their insurance coverage, premiums and market options.

- As a Commercial Risk Advisor and Consultant, I focus specifically on property and casualty insurance. It’s more important than ever to work with clients to understand their goals and create a personalized risk management plan for their unique exposures.

Megan Hatch

CPCU, AIC, CWCA

Commercial Risk Consultant

You don’t have to respond to this changing risk landscape alone. We’re here to help you navigate these trends with ease. For additional workers’ compensation resources, risk management guidance and insurance solutions, contact us today.