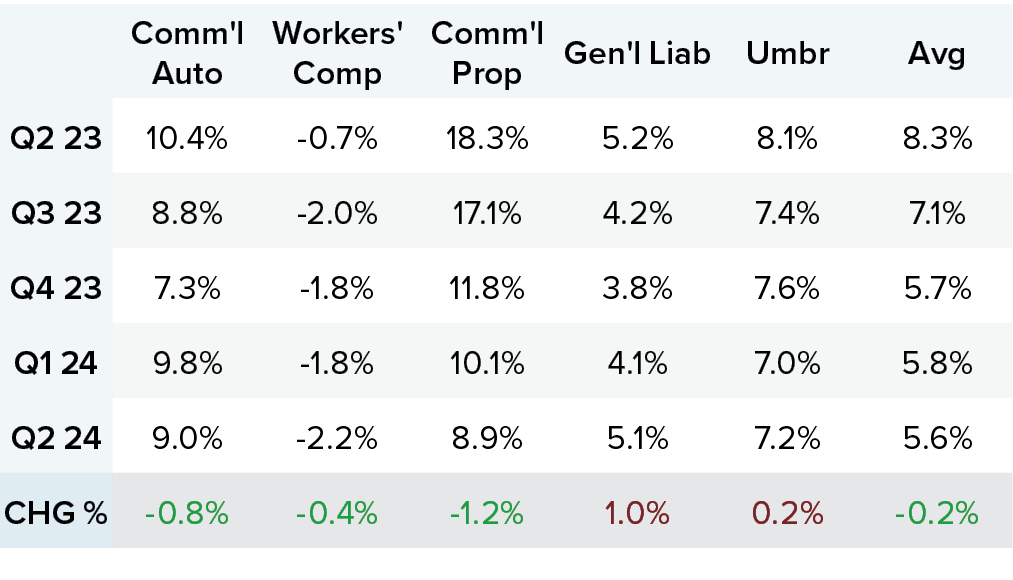

Signs of softened P&C market conditions were evident in Q2, according to CIAB’s quarterly survey. Average increases for all account sizes averaged 5.2%, down significantly from Q1 2024’s 7.7%. Respondents indicated capacity increases and underwriting competition contributed to Q2’s shift.

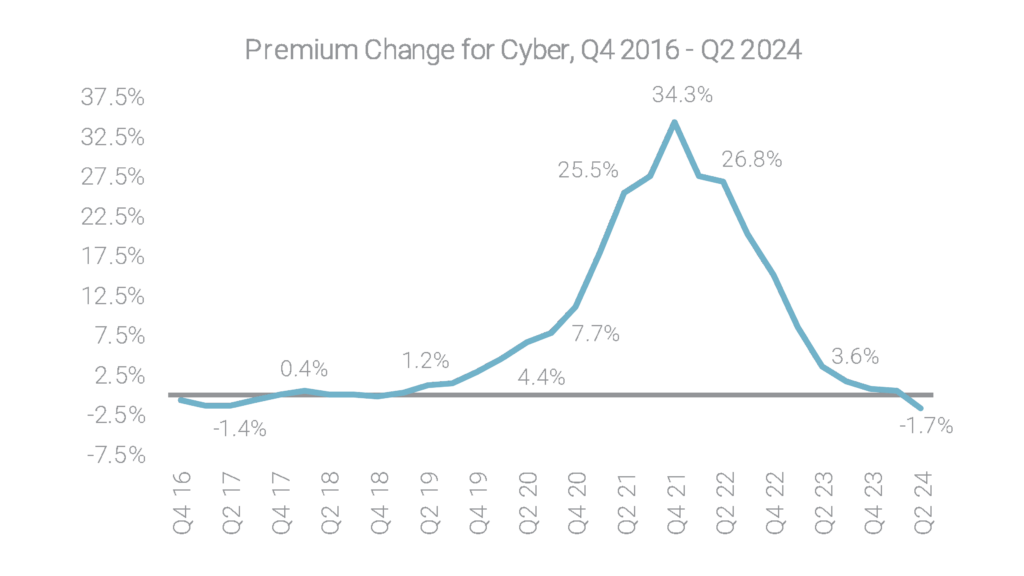

Cyber Sees Rate Reduction for First Time Since Q4 2018

Cyber premiums saw an average reduction of 1.7% in Q2 2024, marking the first cyber premium decrease since Q4 2018. One respondent noted an increase in carrier appetite drove competition, leading to price stabilization.

Cyber’s significant decrease beat expectations stemming from an increase in ransomware activity, reported cyber claims and newsworthy events like the CrowdStike IT outage.

For a consultative approach to navigating coverage and pricing changes within the insurance market, contact a UNICO Advisor.

For more information, download the full report below.

The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report Q1 2024 (April 1 – June 30). Readers should contact legal counsel or an insurance professional for appropriate advice.