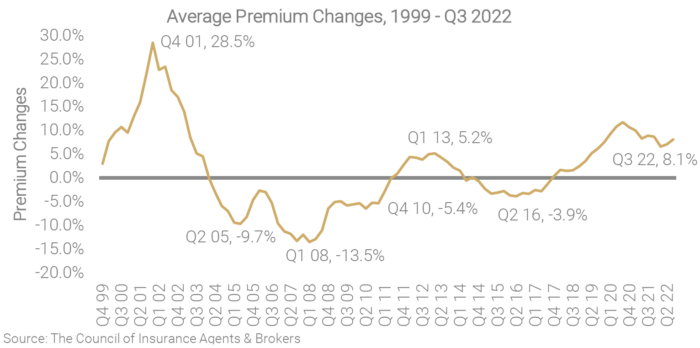

Market conditions remained challenging in Q3 2022, with average premium increase of 8.1% across all account sizes, up from 7.1% in Q2 2022.

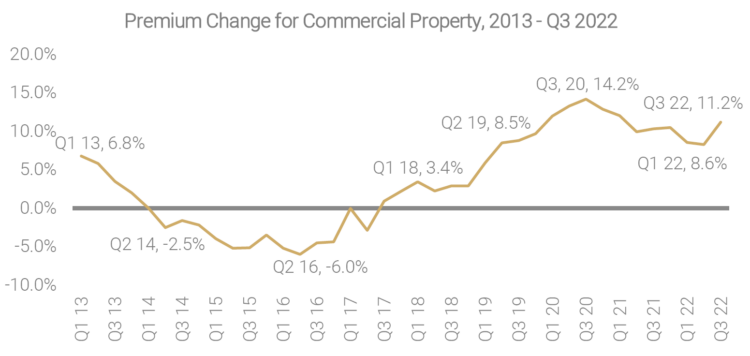

Premium pricing moderation continued for most lines of business, with a few exceptions. Commercial property, for example, saw premiums rise an average 11.2% in Q3 2022, compared to 8.3% in Q2. Commercial auto and cyber also saw notable increases, at 7.6% and 20.3% respectively.

Workers compensation premiums continued their decline this quarter, at -0.7%.

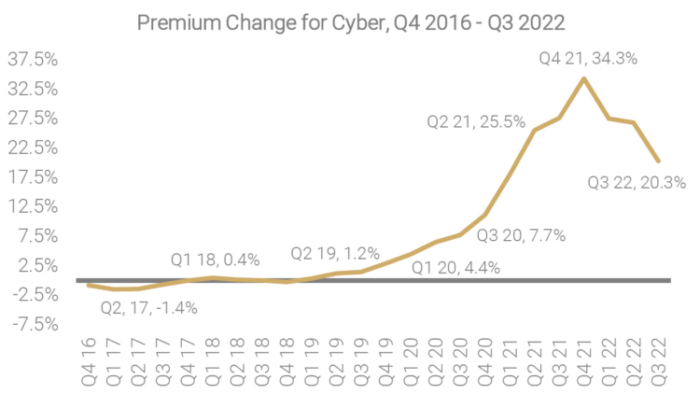

Cyber premium increases down from record high

Cyber continued to be a challenge in Q3 2022, though the average premium increase for the line this quarter was 20.3%, down noticeably from 26.8% in the previous quarter, and down significantly from its record high peak of 34.3% in Q4 2021. For insureds who have implemented appropriate risk controls, premiums have stabilized slightly. However, clear problems remain, such as higher deductibles, and the addition of sublimits to ransomware and cyber extortion coverages, even with a clean loss history.

For a consultative approach to navigating coverage and pricing changes within the insurance market, contact a UNICO Advisor.

For more information, download the full report below.

The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report Q3 2022 (July 1 – September 30). Readers should contact legal counsel or your UNICO Advisor for appropriate advice.