Premium increases remained steady with an average increase of 8.9% across all account sizes in Q2 2023. This is a slight increase from Q1’s 8.8%. According to The Council of Insurance Agents & Brokers Commercial Property/Casualty Market Index, Q2 2023 marks the 23rd consecutive quarter of increases.

Commercial Property Spikes Among Severe Weather

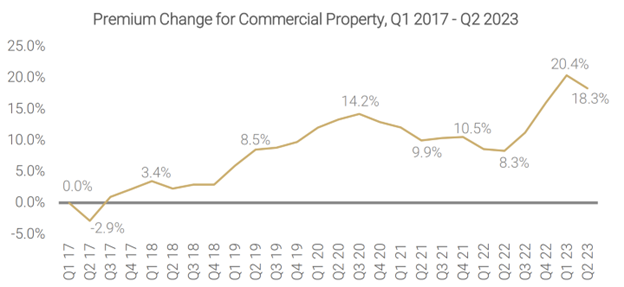

In contrast, commercial property premiums climbed by an average of 18.3% in Q2 2023. Natural catastrophes seem to be the driving force behind high premiums, high deductibles and reduced limits. Severe thunderstorms accounted for around $34 billion in losses in the U.S., the highest ever insured in a six-month period. $34 billion in losses is nearly twice as high as the average annual natural catastrophe losses of $18.4 billion.

Difficulties with reinsurance also compounded existing issues with this line.

Additional Market Trends

Workers’ Compensation recorded its’ 6th straight quarter of decreases, Q2 coming in at -0.7%. Commercial Auto reported an increase of 10.4%, marking the 50th straight quarter of premium increases.

For a consultative approach to navigating coverage and pricing changes within the insurance market, contact a UNICO Advisor.

For more information, download the full report below.

The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report Q1 2023 (April 1 – June 30). Readers should contact legal counsel or your UNICO Advisor for appropriate advice.