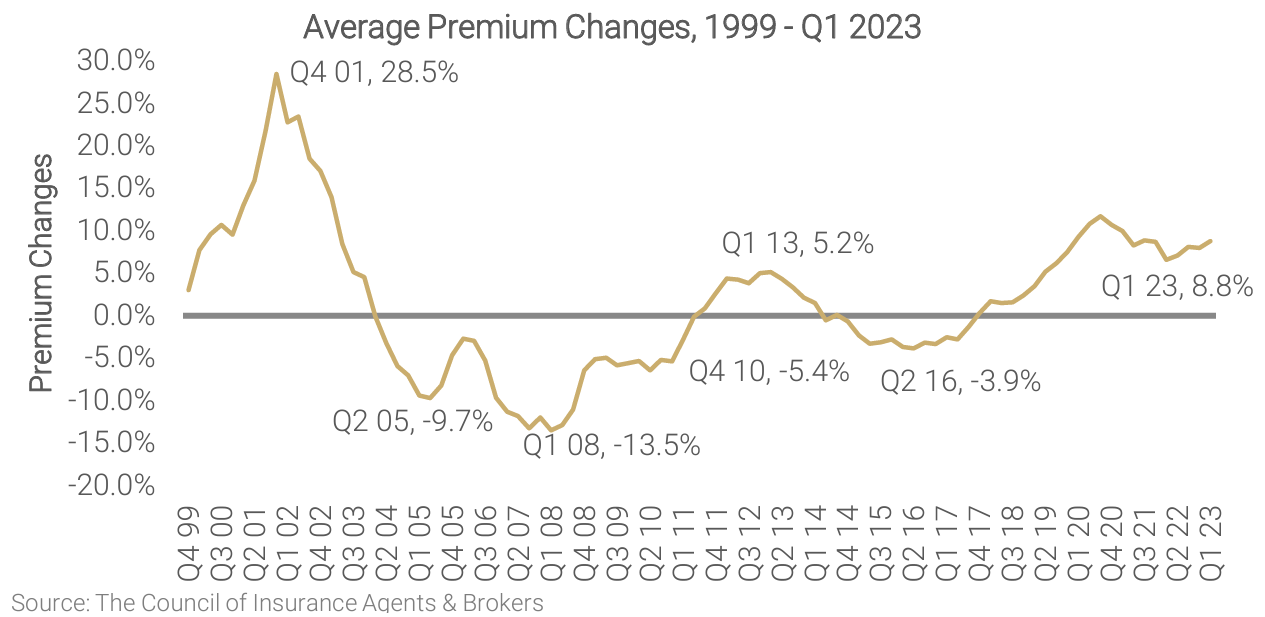

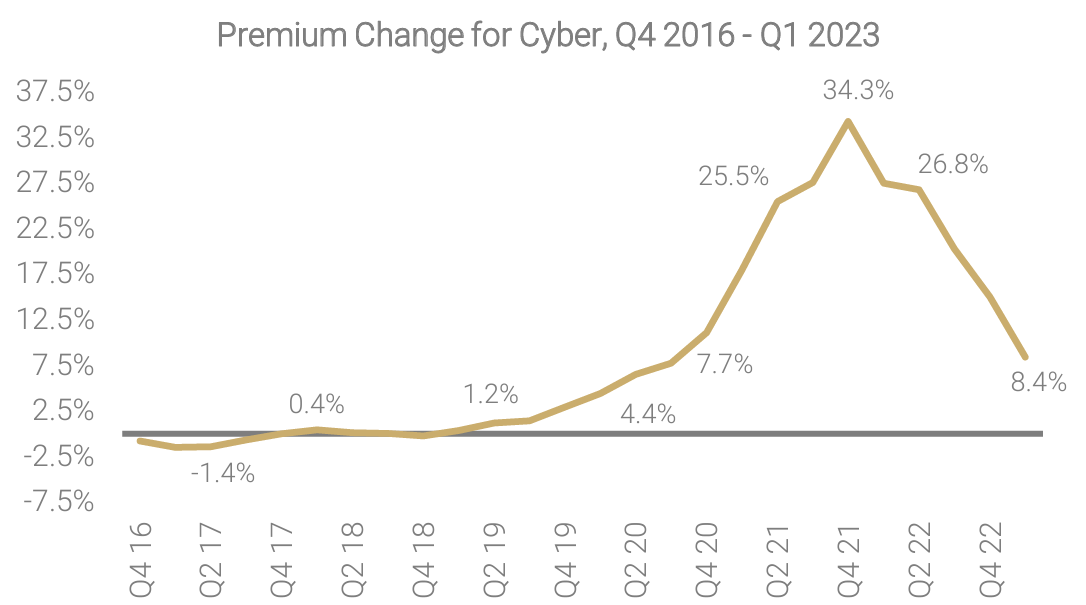

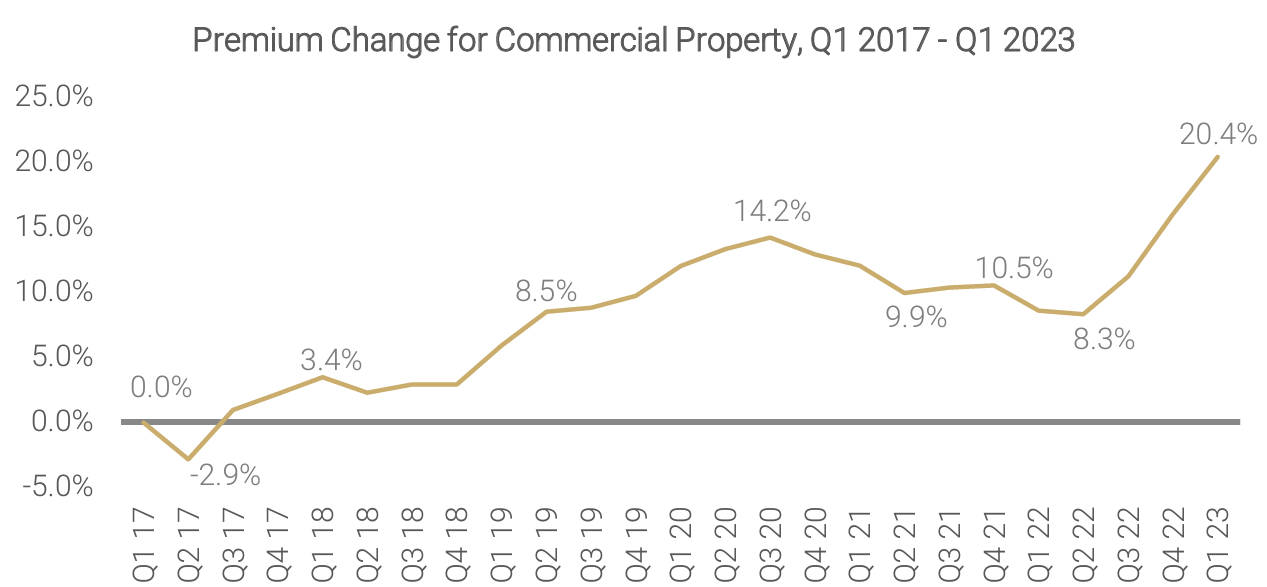

The Q1 results indicate moderate premium pricing increases in most lines, continuing to climb for the 22nd consecutive quarter according to The Council of Insurance Agents & Brokers Commercial Property/Casualty Market Index. Cyber markets showed some signs of relief this quarter.

However, commercial property premiums rose significantly by 20.4% in Q1 2023, marking the first increase over 20% since 2001. Cyber markets showed some signs of relief this quarter. However, commercial property premiums spiked by 20.4% in Q1 2023, which is the first time since 2001 that this line experienced an increase of over 20%.

Commercial Property Sees Highest Spike Since 2001

Commercial property skyrocketed from an average of 8.3% in Q2 2022 to this quarter’s average 20.4% price hike. Insurers’ pressure for rate may not be unfounded—61% of CIAB respondents said they saw a jump in claim frequency in addition to inflation. A majority (85%) also said they saw a significant decrease in underwriting capacity. Many respondents also cited stricter underwriting, with building age a determining factor in getting coverage.

Other Markets of Note

Increases for umbrella liability slowed from 9.6% in Q4 2022 to 8.5%, while commercial auto prices were up slightly, with an average increase of 8.3% from 7.3% in Q4. Workers’ compensation prices decreased an average of 0.5%, while general liability increases moderated to 4.6%.

For a consultative approach to navigating coverage and pricing changes within the insurance market, contact a UNICO Advisor.

For more information, download the full report below.

The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Report Q1 2023 (January 1 – March 31). Readers should contact legal counsel or your UNICO Advisor for appropriate advice.