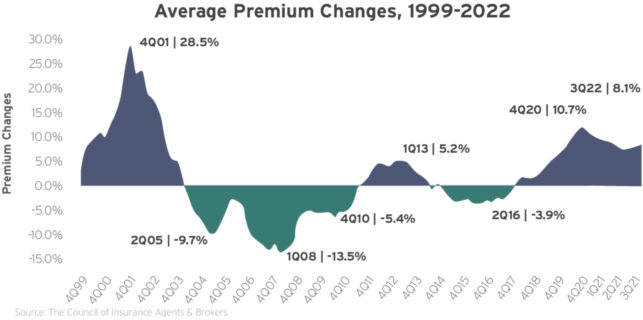

It is true that inflation is causing a ripple effect in various industries, including the insurance market.

Other factors such as higher interest rates, more lawsuits, and severe weather events that have resulted in substantial claim losses are compounding the insurance market.

As a result, insurance companies are adjusting their pricing to reflect these higher costs, which is why there will be an increase on your Home & Auto policies for your renewal.

Consider taking steps to reduce your risk. You may qualify for potential policy discounts or better coverage options. These discounts can include:

- Higher deductible discounts

- In addition to Smoke Detectors:

- Centrally Monitored Smoke Alarms

- Centrally Monitored Burglar Alarms

- Replace your roof with impact resistant shingles.

- Fire Suppression Systems

- Vehicle telematics apps that monitor and reward for safe driving habits.

- Water damage detection systems.

As your Personal Risk Advisor, our primary goal is to ensure that you have the right insurance coverage for your needs while staying within your budget. To achieve this, we constantly monitor market conditions and keep in close contact with insurance carriers to remain up-to-date on any changes in pricing or coverage terms and conditions.