Trust the specialists in communications

Our suite of Transactional Risk insurance products allow parties to efficiently allocate risk inherent in transactions, increase deal value and maximize returns, strategically enhance a buyer’s bid in competitive auctions and bridge gaps in deals with significant obstacles to closing.

- Customized transaction solutions

- Consulting services

- Consolidation services

- Reps and warranties solutions

PROPAdvantages

Advantages

For the buyer

- Understand current risk profile

- Determine potential holes of insurance platforms

- Understand clear plan for transition

- Provide clear checklist for buyer

For the seller

- Provide certainty for buyer and suitors

- Provide executive summary for buyers

- Provide checklist to protect insurance holes and gaps

- Update policies and procedures to strength due-diligence

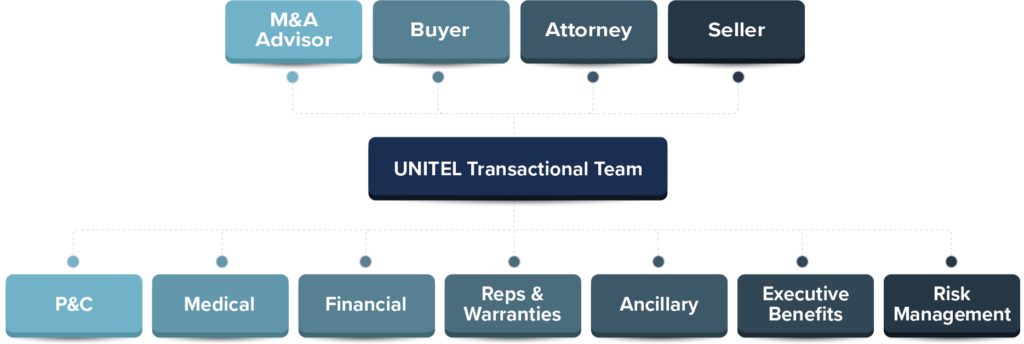

A team approach

Transactional team

UNITEL’s unique approach is the be heavily involved as a resource early in the process to assist all aspects and facets of the transaction. Data gathering, collection, and schedules are difficult to assist the vast due-diligence process of the team. UNITEL’s ability to solidify and educate all of the separate members from advisors, attorneys, carriers, and both the buyer/seller allows both efficiency and transparency of the process. By committing specific resources to the transactional team, UNITEL has the ability to break down communication silos in order to keep transaction stages on track.

UNITEL expertise

The communication industry brings an array of unique and ever-changing risks. At UNITEL, we take a creative approach to customizing risk solutions for your current and future needs.

UNITEL Insurance is a member of over 45 state and national associations. These connections keep us on the forefront of industry trends; providing us a wealth of knowledge and tools to assess the evolving digital world and your business.

Our communication partners range from publicly traded to privately owned companies:

Transactional services

Customized transaction solutions

- Representations and warranties

- Contingent liability

- Executive benefits

- D&O tail policy

- E&O/Cyber tail policy

Consulting services

- Policy transition

- Risk management integration assistance

- Claims analysis

- Policy and coverage review

- Risk management standardization

Consolidation services

- Integrate policies and limits

- Standardization of risk management program

- Post-close confirmations

Consolidation

Reps and warranties solutions

- RWI – Lite

- Standard RWI

- RWI – Portfolio

- RWX – Software and transparency

Additional services

Executive benefits

- Acquisitions

- Captial/debt influx

- Key person

- Life insurance and golden handcuff